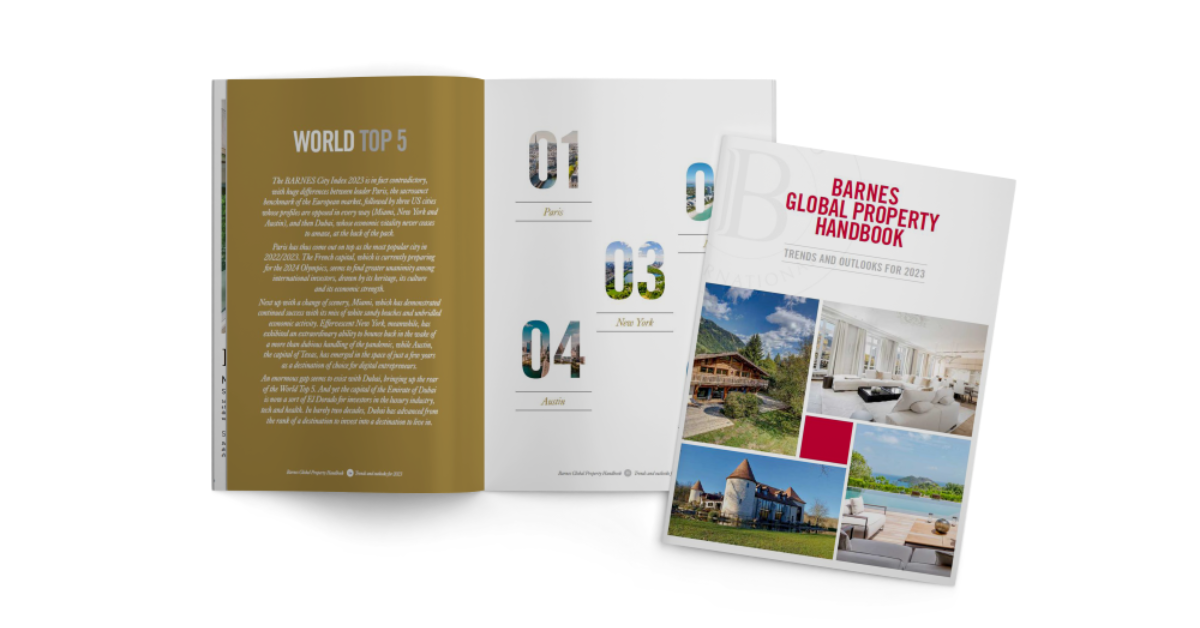

Despite the global economic instability and the return of inflation, luxury real estate has once again proved itself as the ultimate safe haven investment against uncertainty. The BARNES Global Property Handbook, published once a year, gives an insight on the global real estate markets and the most sought-after destinations. This year, the Top 5 of the BARNES City Index is in fact contradictory, with Paris, the european staple, standing at the top of the ranking. Following the French capital are three U.S cities : Miami, New York and Austin. Finally, Dubai takes on the 5th position with its impressive economic vitality.

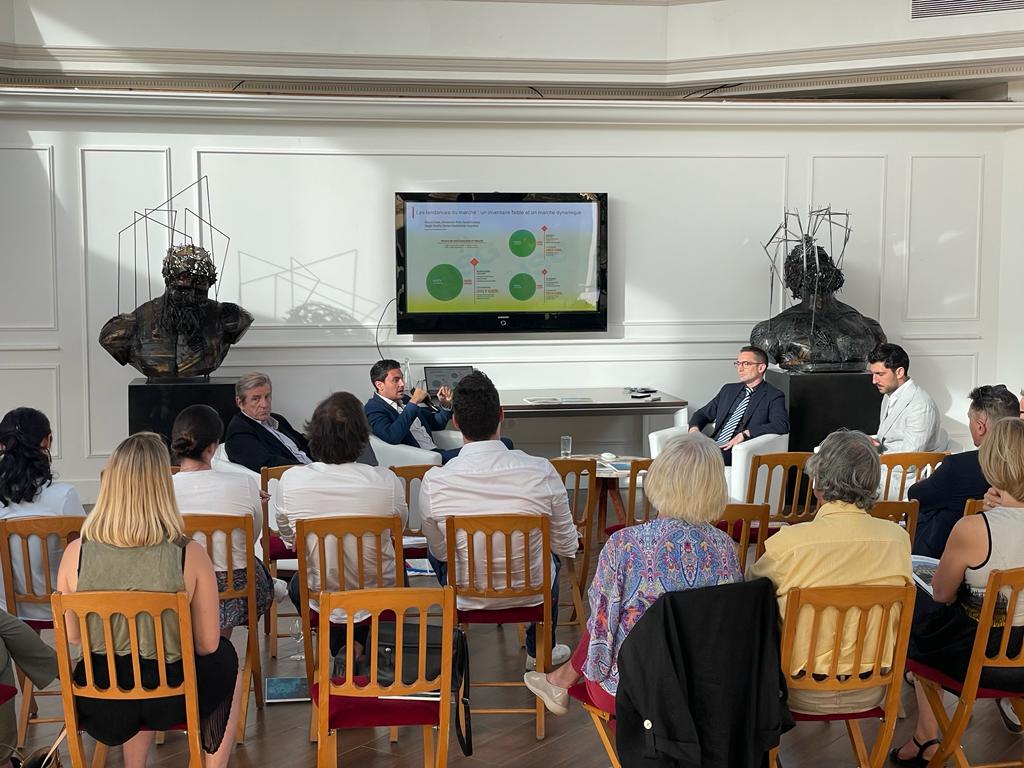

« Driven by a real business spirit, upmarket buyers are now exhibiting an attitude for diversification, not only in the type of properties that interest them […] but also in their location. From New York to Paris and Lisbon, from Miami to Dubai and Saint Tropez, and from the Atlantic Coast to winter sport resorts », comments Thibault de Saint Vincent, President of BARNES.

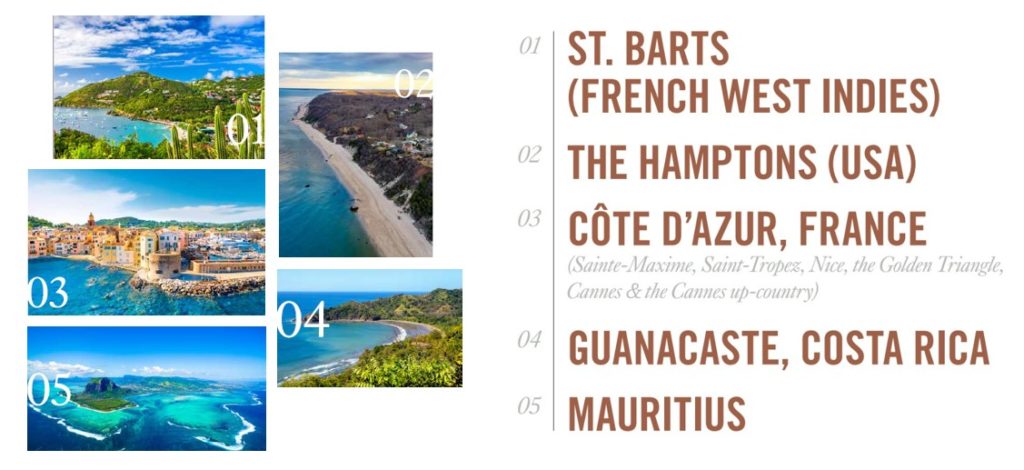

In that matter, secondary residences are on a roll. Regarding oceanfront destinations, the most coveted destinations are : Saint Barts for its idyllic landscapes and delicious gastronomy, The Hamptons for their peace and quietness, The French Côte d’Azur for its architecture and elegance, Guanacaste for its natural and cultural heritage and, finally, Mauritius for its tropical climate and unmatched wildlife.

Furthermore, luxury real estate is in constant evolution and some up-and-coming destinations could become tomorrow’s investments and homes. Tokyo occupies the first place of this ranking with its high productivity and property prices that keep rising. The british capital London takes the second place thanks to its growing number of Ultra High Net-Worth Individuals. On the third place, we observe Rome, also called the “Eternal City” that keeps attracting for its Dolce Vita. Monaco, known for its political stability and safety but also its gastronomy, stands right behing Rome. Finally, Madrid is becoming a safe haven for both europeans and internationals.